Eco-Friendly Assets: Why ESG Is the New Standard

The global real estate market is undergoing a massive transformation where the value of a property is no longer determined solely by its location or square footage. In 2026, the integration of Environmental, Social, and Governance (ESG) criteria has become the primary benchmark for institutional investors and high-profile tenants alike. This shift is driven by a combination of stricter climate regulations, a growing demand for corporate transparency, and the undeniable financial benefits of energy efficiency.

Buildings that fail to meet these green standards are increasingly being labeled as “stranded assets,” losing their market appeal and facing higher insurance premiums. Meanwhile, eco-friendly structures are commanding higher rents and achieving better occupancy rates because they align with the sustainability goals of modern corporations.

The rise of ESG represents a fundamental change in how we perceive commercial value, moving toward a model where planetary health is directly linked to financial profit. Understanding why ESG is the new gold standard is essential for anyone looking to navigate the competitive waters of commercial real estate today. This comprehensive guide will break down the pillars of green building and explain how sustainable practices are reshaping the future of the industry.

A. The Three Pillars of ESG in Real Estate

To understand the impact on property value, we must first deconstruct the acronym that is dominating boardroom discussions. ESG is a holistic framework that measures how a company or an asset impacts the world and its people.

In the context of a building, these pillars translate into specific operational goals and architectural choices. Each pillar works in tandem to create a resilient and profitable long-term investment.

A. Environmental focuses on the carbon footprint, energy consumption, waste management, and water efficiency of the physical structure.

B. Social examines how the building affects the people inside and around it, including health, safety, and community engagement.

C. Governance looks at the transparency of the management, ethical supply chains, and compliance with local and international laws.

D. Synergy occurs when a green roof (Environmental) provides a garden for workers (Social) and is managed by a transparent board (Governance).

E. Data Tracking is the backbone of ESG, requiring sensors and software to prove that a building is actually meeting its targets.

B. The Economic Reality of Energy Efficiency

One of the most immediate benefits of green buildings is the significant reduction in utility costs. High-efficiency HVAC systems and smart glass can lower energy bills by as much as 30% to 50% compared to legacy buildings.

These savings go directly to the bottom line, increasing the Net Operating Income (NOI) for the owner. As energy prices fluctuate globally, buildings with low consumption become much safer investments for long-term holders.

A. Smart LED Lighting uses sensors to dim or turn off lights when rooms are not in use, drastically cutting electricity waste.

B. High-Performance Insulation maintains internal temperatures with minimal mechanical help, reducing the load on heating and cooling systems.

C. Variable Speed Drives in motors ensure that fans and pumps only work as hard as necessary, rather than running at full speed constantly.

D. Renewable Integration like on-site solar panels allows buildings to generate their own power and sometimes sell the excess back to the grid.

E. Predictive Maintenance uses AI to identify equipment that is about to fail, preventing energy-draining malfunctions before they occur.

C. The Rise of “Green Premiums” and “Brown Discounts”

The market has reached a tipping point where tenants are willing to pay a “green premium” for sustainable spaces. This isn’t just about ethics; it’s about the company’s own ESG reporting and its ability to attract top talent.

Conversely, buildings that are energy-inefficient or lack wellness certifications are facing “brown discounts.” These properties are harder to lease and often require expensive retrofitting just to meet the new minimum legal standards.

A. Increased Yield is often reported by owners of LEED-certified buildings, who see higher resale values compared to non-certified peers.

B. Faster Leasing occurs because multinational corporations have internal mandates to only occupy carbon-neutral or high-rated ESG spaces.

C. Tenant Retention is higher in green buildings because the indoor environment is more comfortable and healthier for the employees.

D. Financing Advantages include “Green Loans” with lower interest rates for projects that can prove they meet strict sustainability criteria.

E. Future-Proofing ensures that a property will not become obsolete when new carbon taxes or building emissions laws are enacted.

D. Social Impact: Wellness and Human Capital

The “S” in ESG is often overlooked, but it is becoming a major differentiator in the office and residential sectors. A green building is a healthy building, focusing on air quality, natural light, and physical activity.

Studies show that employees in well-ventilated, naturally lit offices take fewer sick days and are significantly more productive. For a corporate tenant, the cost of labor is much higher than the cost of rent, making wellness a smart business move.

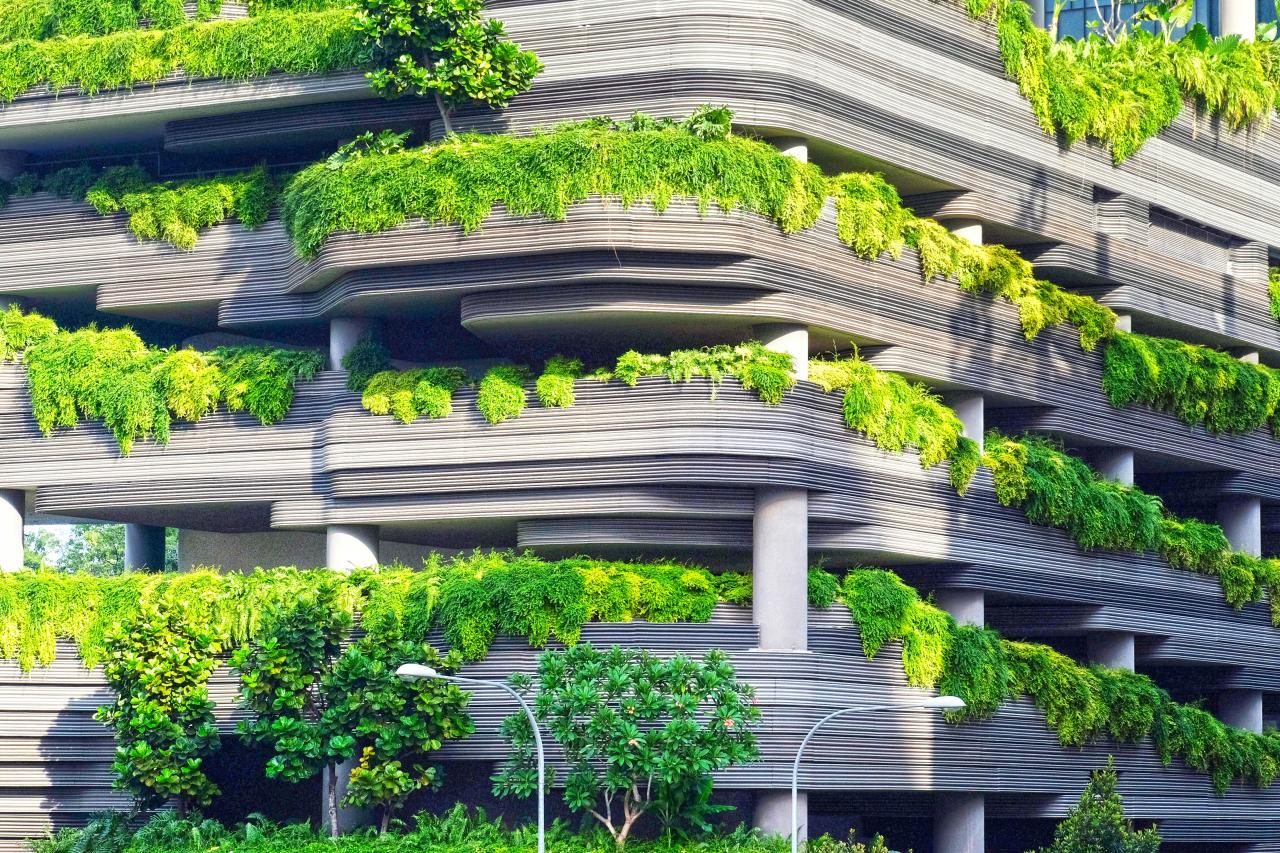

A. Biophilic Design incorporates natural elements like indoor plants and water features to reduce stress and improve mental health.

B. Advanced Air Filtration removes pollutants and CO2, preventing the “sick building syndrome” that plagues older commercial properties.

C. Circadian Lighting mimics the natural progression of sunlight to help regulate the sleep-wake cycles of the building’s occupants.

D. Active Design encourages movement through the use of attractive staircases, standing desks, and on-site fitness facilities.

E. Community Spaces foster social interaction and a sense of belonging, which are vital for long-term tenant satisfaction.

E. Decarbonization and the Net Zero Goal

The ultimate target for the real estate industry is “Net Zero” carbon emissions. This involves both “operational carbon” (energy used to run the building) and “embodied carbon” (emissions from construction materials).

Reducing embodied carbon is the new frontier, leading to a surge in the use of recycled steel, cross-laminated timber, and low-carbon concrete. The goal is to create buildings that have a neutral or even positive impact on the environment over their entire lifecycle.

A. Operational Decarbonization is achieved through total electrification and the elimination of on-site fossil fuel burning for heat.

B. Embodied Carbon Tracking requires developers to account for the environmental cost of every brick and beam used in construction.

C. Circular Economy practices involve designing buildings that can be easily deconstructed and repurposed rather than demolished.

D. Carbon Offsetting is a temporary measure where owners invest in environmental projects to balance out the building’s remaining emissions.

E. Energy Storage systems like large-scale batteries allow buildings to store clean energy for use during peak demand times.

F. The Role of Smart Technology in ESG

You cannot manage what you cannot measure, which is why smart technology is inseparable from ESG. IoT sensors are the “eyes and ears” of a green building, providing a constant stream of data on performance.

This data is used to generate ESG reports for investors and regulators. In 2026, real-time transparency has replaced annual audits as the gold standard for corporate governance.

A. Digital Twins are virtual replicas of a building that allow managers to test energy-saving strategies before implementing them.

B. Occupancy Sensors provide data on how spaces are actually used, allowing for the optimization of lighting and climate control.

C. Water Leak Detection systems prevent thousands of gallons of waste and protect the building’s structure from hidden damage.

D. Automated Reporting tools compile data into standardized formats for certifications like GRESB or the EU Taxonomy.

E. Tenant Portals allow the people inside the building to see their own energy use and participate in sustainability challenges.

G. Regulatory Pressure and Global Standards

Governments around the world are no longer making “green” a suggestion; they are making it a law. From New York’s Local Law 97 to the EU’s Green Deal, the legal landscape is tightening.

Failure to comply with these regulations can lead to massive fines that far outweigh the cost of upgrading the building. This regulatory “stick” is pushing the entire industry toward the ESG gold standard faster than ever before.

A. Energy Performance Certificates (EPCs) are becoming mandatory for any commercial sale or lease in many major jurisdictions.

B. Carbon Taxes are being levied on buildings that exceed a specific emission threshold per square foot.

C. Mandatory Disclosures require publicly traded companies to report on the climate risks associated with their real estate holdings.

D. Zoning Incentives are being offered to developers who go beyond the minimum green requirements in their new projects.

E. Standardized Frameworks like LEED, BREEAM, and Green Star provide a common language for measuring building performance globally.

H. Water Scarcity and Management

While energy often gets the spotlight, water management is a critical component of the “E” in ESG. As global water scarcity increases, buildings that can recycle and conserve water will be much more resilient.

Smart buildings now utilize gray-water systems to flush toilets and irrigate landscaping. This reduces the burden on municipal systems and lowers the building’s operating costs during droughts.

A. Low-Flow Fixtures reduce water consumption by up to 40% without sacrificing the user’s experience.

B. Rainwater Harvesting captures water from roofs and stores it for non-potable uses throughout the facility.

C. Smart Irrigation uses weather data to ensure that plants are only watered when necessary, preventing over-saturation.

D. Xeriscaping involves using drought-tolerant plants that require very little water to maintain a beautiful landscape.

E. Water Quality Monitoring ensures that recycled water is safe for its intended use and protects the health of the occupants.

I. Governance: Transparency and Ethics

The “G” in ESG ensures that the building is managed with integrity. This includes everything from how the janitorial staff is treated to how the management firm handles its finances.

Good governance reduces the risk of scandal and legal trouble, which can be devastating for a property’s reputation. Investors look for transparency because it signals that the asset is being managed for long-term stability.

A. Ethical Procurement means ensuring that the materials and services used by the building are not linked to human rights abuses.

B. Anti-Corruption Policies prevent the “pay-to-play” schemes that have historically plagued the construction and real estate sectors.

C. Stakeholder Engagement involves listening to the concerns of tenants and the local community to build a better relationship.

D. Risk Management protocols identify potential climate risks, such as flooding or wildfires, and create mitigation plans.

E. Diversity and Inclusion in the management team brings a wider range of perspectives to the table, improving decision-making.

J. The Financial Case for Retrofitting

Not every green building has to be a new construction. In fact, some of the biggest ESG gains are made by retrofitting older, inefficient structures.

Deep retrofits can take a “Class C” building and turn it into a high-performing “Class A” asset. This is often more profitable for developers than building from scratch, especially in dense urban centers where land is scarce.

A. Window Upgrades can significantly improve a building’s thermal envelope and reduce noise pollution from the street.

B. HVAC Modernization replaces old, clunky boilers with heat pumps and high-efficiency chillers.

C. Roofing Replacements with “cool roofs” or green roofs can lower the internal temperature of the building by several degrees.

D. Envelope Sealing prevents air leaks, which are one of the most common causes of energy waste in older structures.

E. Elevator Modernization uses regenerative braking to capture energy that is normally lost during descent.

K. ESG and the Future of Financing

The banking sector has fully embraced ESG, and it is changing how developers get funded. “Sustainability-Linked Loans” are a new financial product where the interest rate is tied to the building’s performance.

If the building meets its energy-saving targets, the interest rate goes down. If it fails, the rate goes up. This creates a powerful financial incentive for owners to stay committed to their ESG goals.

A. Green Bonds allow investors to put money specifically into environmentally friendly projects with high transparency.

B. Impact Investing attracts a new generation of capital that is looking for both a financial return and a positive social outcome.

C. Equity Premiums are being seen for REITs (Real Estate Investment Trusts) that have strong ESG scores across their entire portfolio.

D. Lower Insurance Premiums are available for green buildings because they are seen as having lower long-term risk profiles.

E. Institutional Mandates mean that pension funds and insurance companies are legally required to shift their portfolios toward ESG assets.

L. Building a Sustainable Real Estate Legacy

Investing in ESG is not just about the next quarter; it’s about the next century. Sustainable buildings are more durable and better equipped to handle the challenges of a changing climate.

As a property owner, your ESG strategy defines your legacy. Do you want to own a building that contributes to the problem, or one that is part of the solution? The market has made its choice, and the gold standard is here to stay.

A. Longevity is built into green buildings through higher-quality materials and better engineering standards.

B. Brand Value is enhanced when your company is associated with landmark sustainable projects.

C. Adaptability ensures the building can be easily updated as new green technologies emerge in the future.

D. Employee Pride is higher in companies that occupy green spaces, aiding in recruitment and morale.

E. Environmental Stewardship provides the personal satisfaction of knowing your business is protecting the planet for future generations.

Conclusion

The shift toward ESG in commercial real estate is the most significant market movement of our generation.

We are entering an era where energy efficiency is no longer a luxury but a fundamental requirement for value.

Buildings that prioritize the health and wellness of their occupants are consistently outperforming their traditional peers.

The financial industry has aligned its incentives to reward those who take sustainability and governance seriously.

Regulatory pressure will only continue to increase, making early adoption of ESG the only logical business strategy.

Smart technology provides the transparency needed to prove that green buildings are delivering on their promises.

Retrofitting our existing urban infrastructure is a massive opportunity for investors to create value and save the planet.

Water management and decarbonization are the next major hurdles that the industry must cross to reach Net Zero.

Good governance reduces risk and builds the trust necessary for long-term institutional investment and growth.

The “green premium” is a reality that is reshaping the competitive landscape of our major cities and suburbs.

A property’s ESG score is now just as important as its credit rating or its physical location in the market.

Choosing to invest in green buildings is the only way to ensure your real estate portfolio remains relevant and profitable.