Profit From the E-Commerce Logistics Property Surge

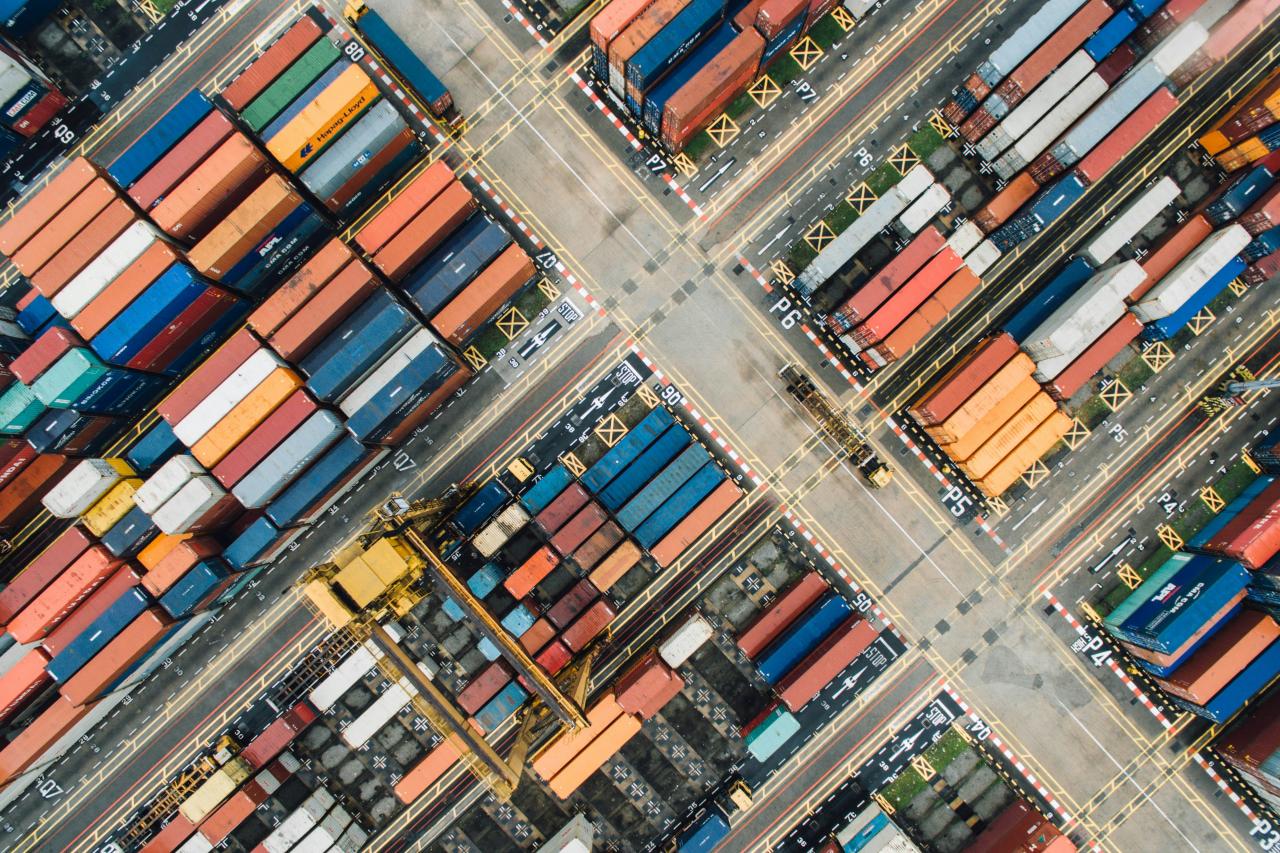

The global landscape of commercial real estate is witnessing a monumental transformation, driven by the explosive growth of online shopping and a complete overhaul of the global supply chain. For decades, investors overlooked industrial warehouses as “boring” assets, preferring the prestige of downtown office towers or flashy retail malls. However, the dawn of 2026 has solidified logistics real estate as the new “gold standard” for those seeking resilient and high-yielding investment portfolios.

As consumers increasingly expect lightning-fast delivery times, the demand for sophisticated distribution centers located near major urban hubs has reached an all-time high. This surge is not merely a temporary trend but a fundamental shift in how goods move from manufacturers to the front doors of billions of people. Modern warehouses are no longer just cold storage boxes; they are high-tech hubs filled with robotics, AI-driven sorting systems, and sustainable energy solutions.

Investors who understand the mechanics of “last-mile” delivery and the critical role of warehouse locations are positioning themselves for significant long-term gains. In this deep dive, we will explore why logistics is the most exciting sector in real estate today and how you can capitalize on this unprecedented boom.

A. The Core Drivers of the Logistics Boom

The primary engine behind this real estate revolution is the massive shift in consumer behavior toward e-commerce. Every billion dollars in online sales requires significantly more warehouse space than traditional retail sales because of the complexity of individual order fulfillment.

Beyond just “shopping,” companies are moving away from “just-in-time” inventory to “just-in-case” models. This means businesses are holding more stock locally to prevent the shortages that plagued the early 2020s, requiring even more square footage.

A. The transition to e-commerce necessitates about three times more warehouse space than brick-and-mortar retail operations.

B. Supply chain resilience has become a top priority for global corporations, leading to increased domestic storage needs.

C. Global trade patterns are shifting toward “near-shoring,” bringing manufacturing and storage closer to the final consumer market.

D. High-frequency delivery expectations mean that goods must be stored in multiple locations rather than one central hub.

E. The rise of “reverse logistics,” or the processing of returns, creates an additional and massive demand for industrial space.

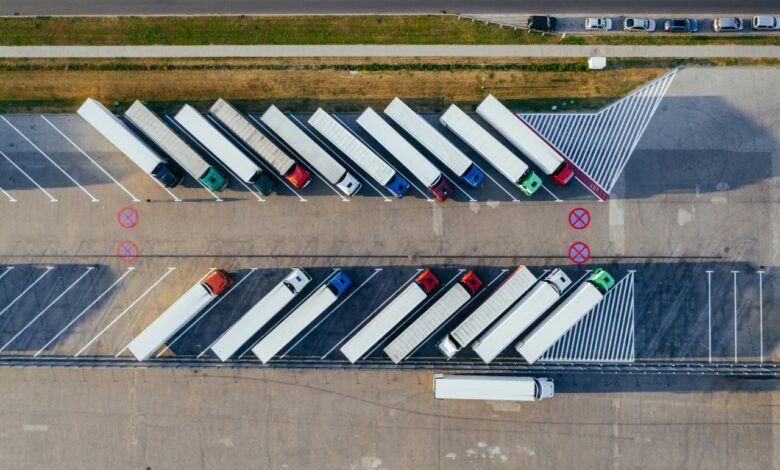

B. Understanding Last-Mile Delivery Hubs

“Last-mile” delivery is the final and most expensive leg of the journey for any package. It refers to the movement of goods from a regional distribution center to the customer’s doorstep.

Because speed is the ultimate competitive advantage, companies are willing to pay a premium for small, urban warehouses. These facilities allow delivery vans to make multiple trips per day, drastically reducing costs and transit times.

A. Urban infill locations are highly sought after because they provide immediate access to dense populations.

B. Proximity to major highways and arterial roads is the most critical factor in determining the value of a last-mile site.

C. Smaller, multi-story warehouses are becoming common in cities where land prices are high and horizontal space is limited.

D. Electric vehicle (EV) charging infrastructure is now a standard requirement for modern last-mile delivery hubs.

E. Zoning for last-mile centers is often difficult to obtain, which creates a high barrier to entry and protects existing investors.

C. The High-Tech Evolution of Warehouse Assets

The warehouses of 2026 look nothing like the dusty storage rooms of the past. Automation and robotics have turned industrial real estate into a high-tech asset class that requires specialized construction.

From autonomous forklifts to vertical mezzanine floors that double the usable space, technology is allowing owners to maximize the “yield” of every square foot. Investors need to understand these tech requirements to ensure their properties don’t become obsolete.

A. High ceiling clearances (often 40 feet or more) are now required to accommodate advanced vertical racking and robotics.

B. Floor load capacities must be significantly higher to support heavy automated machinery and dense storage systems.

C. Enhanced electrical power supply is necessary to fuel the batteries of hundreds of autonomous mobile robots (AMRs).

D. Cold storage integration is a major growth area, driven by the rise of online grocery and pharmaceutical deliveries.

E. High-speed fiber connectivity is the “nervous system” of a modern warehouse, allowing real-time inventory tracking and AI management.

D. Why Institutional Capital is Flooding the Sector

Large pension funds, insurance companies, and REITs (Real Estate Investment Trusts) are moving their capital out of offices and into warehouses. This is because industrial properties offer “sticky” tenants and very low vacancy rates.

In most major markets, industrial vacancy is hovering near record lows, often below 3%. This gives landlords immense “pricing power,” allowing them to raise rents as soon as a lease expires.

A. Long-term leases with high-credit tenants like Amazon, DHL, or Walmart provide incredibly stable cash flow.

B. Industrial properties have lower “tenant improvement” costs compared to offices, meaning more profit stays with the owner.

C. Cap rate compression in the logistics sector has led to massive capital appreciation for early investors.

D. Diversification is a key benefit, as industrial assets often perform well even when the broader economy is stagnant.

E. Inflation protection is built into many industrial leases through annual rent escalations tied to the Consumer Price Index.

E. The Sustainability and ESG Factor in Logistics

Environmental, Social, and Governance (ESG) standards are now a primary concern for warehouse tenants and investors. Large corporations have “Net Zero” targets, and they won’t rent a building that isn’t energy efficient.

Warehouses are actually perfect candidates for green technology. Their massive, flat roofs are ideal for solar panels, which can generate enough power for the building and even provide a secondary income stream for the owner.

A. Solar roof installations can turn a warehouse into a small power plant, reducing operating costs for the tenant.

B. LEED certification for industrial buildings is becoming a standard requirement for institutional-grade investments.

C. LED lighting and smart sensors can reduce energy consumption by up to 60% compared to traditional metal-halide lamps.

D. Gray-water recycling systems can be used for site irrigation and truck washing, lowering the environmental impact.

E. Permeable paving in truck yards helps manage stormwater runoff and reduces the “urban heat island” effect.

F. Dark Stores: The Hybrid Retail-Warehouse Asset

A new sub-sector called “Dark Stores” is emerging. These are former retail locations—like old supermarkets or department stores—that have been converted into mini-fulfillment centers.

They aren’t open to the public; instead, they serve as picking centers for online orders in residential neighborhoods. This allows for “ultra-fast” delivery (under 30 minutes) for groceries and essential items.

A. Conversions of existing retail space can be faster and cheaper than building a new warehouse from the ground up.

B. Strategic locations within residential neighborhoods allow for bicycle or pedestrian-based deliveries.

C. Zoning challenges are common, as local residents may worry about increased truck traffic in their area.

D. Dark stores often feature high-density automated picking systems to maximize efficiency in small footprints.

E. This asset class is a perfect way for retail investors to pivot into the logistics boom without leaving the city.

G. Cold Storage: The High-Yield Frontier

Cold storage is perhaps the most specialized and lucrative segment of the industrial market. With the boom in online grocery and the global distribution of sensitive medicines, demand is far outstripping supply.

These facilities are expensive to build and operate, but they command significantly higher rents than “dry” warehouses. They also tend to have even longer lease terms because the tenant invests so much in the specialized equipment inside.

A. Multi-temperature zones allow a single building to store everything from frozen meat to chilled produce and dry goods.

B. Thermal insulation technology has advanced, allowing for much more efficient temperature maintenance than in previous decades.

C. Redundant power systems (like on-site generators) are non-negotiable for cold storage to prevent catastrophic product loss.

D. Proximity to food processing centers or major ports is the key location driver for cold storage assets.

E. The high cost of specialized construction creates a “moat” that protects investors from sudden oversupply in the market.

H. The Multi-Story Warehouse Revolution

In cities like London, Tokyo, and New York, land is too expensive for single-story warehouses. The solution is the “multi-story” warehouse, where trucks drive up ramps to access the second, third, or even fourth floors.

While these buildings are complex to engineer, they are the only way to meet the demand for last-mile delivery in “Global Gateway” cities. They represent the peak of industrial real estate value.

A. Vertical logistics allow for massive square footage on a relatively small land footprint.

B. Heavy-duty ramps and elevators must be designed to handle the weight and turning radius of delivery trucks.

C. Multi-story facilities often command the highest rents in the entire industrial sector due to their extreme scarcity.

D. Shared loading docks on each level help streamline the flow of goods in and out of the building.

E. These buildings are often designed with “mixed-use” potential, including office or creative space on the top floors.

I. Risks and Challenges for Warehouse Investors

No investment is without risk, and the logistics sector is currently facing headwinds like rising land costs and construction inflation. Interest rates also play a major role in the valuation of these capital-intensive assets.

Additionally, some markets are seeing a surge in “speculative” building, which could lead to temporary oversupply in certain regions. Investors must be diligent in their research and focus on quality locations.

A. Interest rate fluctuations can impact the “cap rates” and overall profitability of industrial developments.

B. Land scarcity in prime urban areas is driving prices to levels that make some projects financially unfeasible.

C. Community opposition and “NIMBYism” (Not In My Backyard) can delay or block new warehouse projects.

D. Technological obsolescence is a risk if a building isn’t designed with the flexibility to adapt to future robotics.

E. Labor shortages for warehouse staff can make a location less attractive to potential tenants.

J. The Role of AI in Managing Logistics Real Estate

Artificial Intelligence is changing how we manage and value warehouses. AI can predict which locations will see the highest demand by analyzing traffic patterns, population growth, and consumer spending data.

For property managers, AI helps optimize everything from energy use to security. A “Smart Warehouse” is easier to manage and more profitable for the owner over the long term.

A. Predictive Analytics help investors identify “up-and-coming” logistics hubs before they reach peak pricing.

B. AI-driven maintenance schedules prevent costly breakdowns in dock doors, HVAC, and lighting systems.

C. Traffic management software reduces congestion in truck yards, allowing for a higher volume of throughput.

D. Smart Security uses AI facial and license plate recognition to secure the perimeter without needing massive guard teams.

E. Digital Twins of the warehouse allow owners to simulate different tenant layouts to maximize rental income.

K. Global Logistics Hotspots to Watch

While the US and Europe remain strong, the biggest growth in logistics real estate is happening in Southeast Asia and India. The “China Plus One” strategy is causing many manufacturers to set up new hubs in Vietnam, Thailand, and Indonesia.

In these emerging markets, the infrastructure is still catching up to the demand. For investors with a higher risk appetite, these regions offer the potential for explosive capital growth.

A. Vietnam has become a major global electronics manufacturing hub, driving massive demand for industrial parks.

B. India’s “Gati Shakti” initiative is modernizing the country’s infrastructure, unlocking new logistics corridors.

C. Mexico is seeing a “near-shoring” boom as US companies move their supply chains closer to home.

D. Poland continues to be the “logistics backbone” of Europe, offering lower costs than Germany with great connectivity.

E. Indonesia’s massive e-commerce growth is creating a desperate need for modern grade-A warehouses in Jakarta and beyond.

L. How to Get Started in Industrial Investing

You don’t need $100 million to profit from the warehouse boom. Individual investors can access this sector through specialized REITs or syndication deals that pool money to buy large assets.

The key is to focus on “Grade A” properties. These are modern, high-clearance buildings with great highway access and sustainable features. These assets always hold their value better during economic downturns.

A. Industrial REITs offer a liquid way to invest in a diversified portfolio of warehouses with a small amount of capital.

B. Real Estate Crowdfunding platforms allow for direct investment in specific logistics projects with lower minimums.

C. Buying small “flex-industrial” units can be a great entry point for local investors looking for steady rental income.

D. Focusing on “Supply-Constrained” markets ensures that your property will always be in high demand.

E. Partnering with experienced industrial developers can provide the expertise needed to navigate the complex construction process.

Conclusion

The current boom in logistics real estate is a once-in-a-generation shift that is redefining the global property market.

E-commerce has created an insatiable demand for warehouse space that is fundamentally different from traditional retail needs.

Investing in last-mile delivery hubs is the most effective way to capitalize on the consumer’s need for instant gratification.

Modern warehouses are becoming high-tech assets that require a deep understanding of robotics and electrical infrastructure.

Institutional capital has validated the sector, making industrial properties a core component of any serious investment portfolio.

Sustainability and ESG compliance are no longer optional but are critical drivers of a property’s long-term market value.

The rise of specialized niches like cold storage and dark stores offers even higher yields for those willing to handle complexity.

Land scarcity in major cities is forcing developers to think vertically, leading to the rise of sophisticated multi-story facilities.

While risks like interest rates and construction costs exist, the underlying demand for logistics space remains incredibly strong.

Artificial Intelligence is providing the data and tools necessary to manage these massive assets with unprecedented efficiency.

Emerging markets in Southeast Asia and Latin America represent the next great frontier for the global logistics revolution.

Taking the first step into industrial real estate today could be the best decision for your financial future in 2026 and beyond.